Automatic Fiscal Policy

Fiscal measures are frequently used in tandem with monetary policy to achieve certain goals. Hospital Inpatient Prospective Payment Systems for Acute Care Hospitals and the Long-Term Care Hospital Prospective Payment System and Policy Changes and Fiscal Year 2022 Rates.

![]()

Education Resources For Teachers Schools Students Ezyeducation

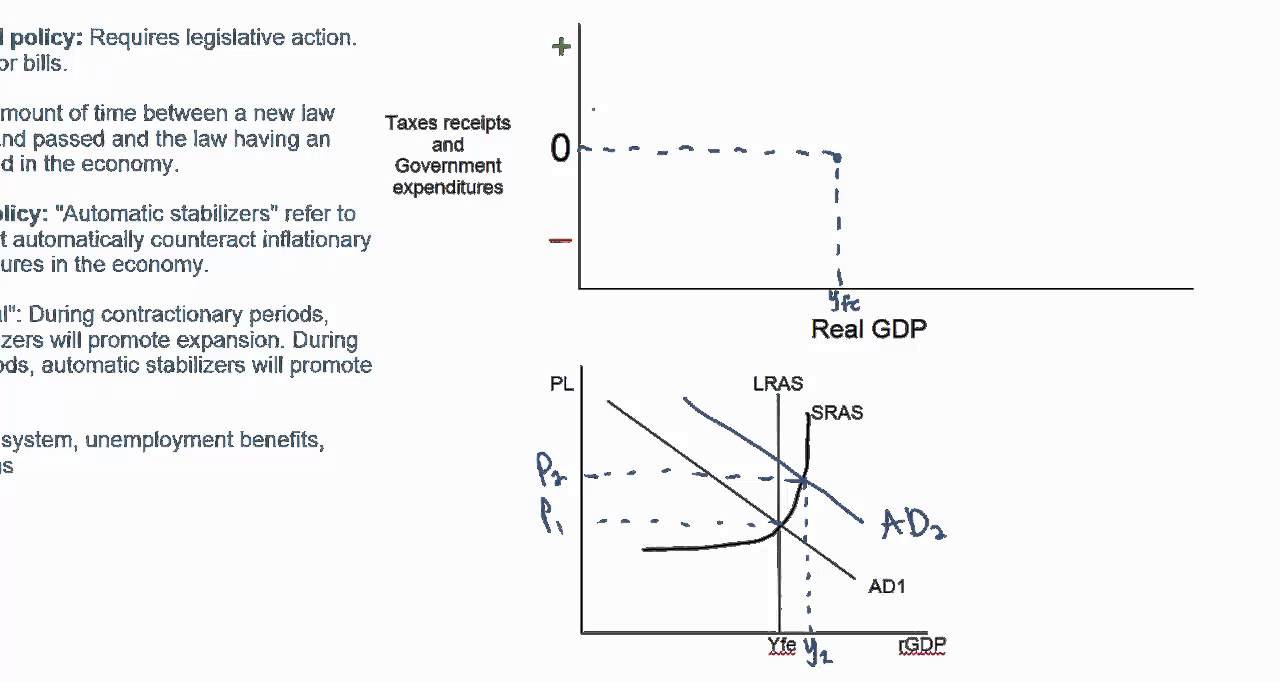

Automatic stabilizers have emerged as key elements of fiscal policy.

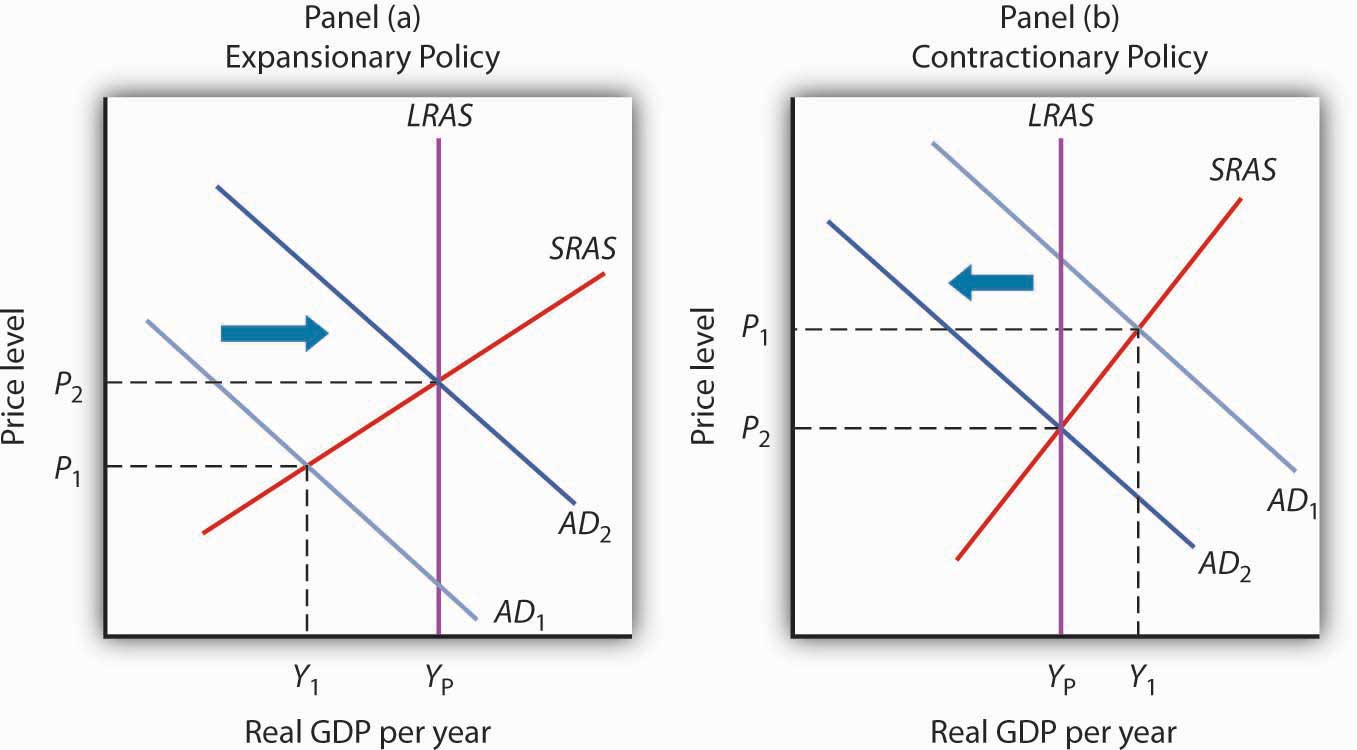

. Learn about expansionary fiscal policytax cuts and government spendingthat are used by governments to boost spending and increase economic activity. In the Peoples Republic of China local filing was suspended for reporting fiscal years commencing in. When an economy is in a state in which growth is getting out of control and therefore causing inflation and asset price bubbles a contractionary fiscal policy can be used to rein in this inflationto bring it to a more sustainable level.

Imagine that Sam is sick. The words fiscal and monetary are thrown around in many economic conversations. History of fiscal policy from great depression to 2010 austerity.

Expansionary or tight fiscal policy. To receive an automatic 6-month extension of time to file your return you must file Form 4868 Application for Automatic Extension of Time To File US. At the same time the Fed should enact contractionary monetary.

When policymakers seek to influence the economy they have two main tools at their disposalmonetary policy and fiscal policy. Hes at home right now and the doctors been called. Central banks indirectly target activity by influencing the money supply through adjustments to interest rates bank reserve requirements and the purchase and sale of government securities and foreign exchange.

Automatic stabilizers which we learned about in the last section are a passive type of fiscal policy since once the system is set up Congress need not take any further actionOn the other hand discretionary fiscal policy is an active fiscal policy that uses. Individual Income Tax Return by the due date of your return. Government deficit spending is a central point of controversy in economics with prominent economists holding differing views.

The mainstream economics position is that deficit spending is desirable and necessary as part of countercyclical fiscal policy but that there should not be a structural deficit ie permanent deficit. History of fiscal policy from great depression to 2010 austerity. A contractionary discretionary policy will lower government spending andor increase.

Fiscal Policy and Recovery from the COVID-19 Recession Congressional Research Service 1 Introduction The economic contraction that began in February 20201 differs from previous contractions including the Great Depression of the 1930s and the Great Recession of 2007-20092 It was caused in large part by concerns about the spread of the Coronavirus. C full employmentD public debt Suppose the government purposely changes the economys cyclically adjusted budget from a deficit of 0 percent of real GDP to a deficit of 3. In Brazil local filing was suspended for reporting fiscal years commencing in 2016 subject to conditions.

In this article we will discuss about the meaning and instruments of fiscal policy. By fiscal policy we refer to government actions affecting its receipts and expenditures which we ordinarily take as measured by the governments net receipts its surplus or deficit. Meaning of Fiscal Policy.

The government should run deficits during. Arlington VA With the fiscal year ending on September 30th and another potential government shutdown looming AFP senior fellow in fiscal policy Kurt Couchman is releasing a new report on failed budget targets of the past and promising options for our future. Explanation of how fiscal policy works in UK spending tax budget deficit.

Automatic stabilizers mostly through the tax system and unemployment insurance provide roughly half the stabilization with discretionary fiscal policy in the form of enacted tax cuts and. Increases in income tax rates and unemployment benefits have enhanced their importance as automatic stabilizers. The introduction in the 1960s and 1970s of means-tested federal transfer payments in which individuals qualify depending on their income added to the nations arsenal of automatic.

Automatic fiscal stabilisers If the economy is growing people will automatically pay more taxes VAT and Income tax and the Government will spend less on unemployment benefits. Quality Programs and Medicare Promoting Interoperability Program Requirements for Eligible Hospitals and Critical Access Hospitals. Politicians often mention how they will bring forth or implement more funding to help stimulate the.

Discretionary Fiscal Policy versus Monetary Policy. Fiscal policy is a powerful instrument of stabilisation. Contractionary Discretionary Fiscal Policy.

Fiscal policy is the use of government spending and tax policy to influence the path of the economy over time. Automatic fiscal stabilisers relate to how government borrowing varies with the economic cycle. At its best discretionary fiscal policy should work in alignment with monetary policy enacted by the Federal Reserve.

Fiscal Policy Tools and the Economy. If you cant file by the due date of your return you should request an extension of time to file. If the economy is growing too fast fiscal policy can apply the brakes by raising taxes or cutting spending.

All of a sudden the doorbell rings and standing at the front door is a doctor. He shows how smart budget goals can help break the cycle of crisis-to-crisis governing that produces. The state will return 125 to each Hoosier taxpayer after they file their taxes in 2022 due to higher than expected state revenue numbers during the 2021 fiscal year.

Fiscal policy measures employed by governments to stabilize the economy specifically by manipulating the levels and allocations of taxes and government expenditures. Study with Quizlet and memorize flashcards containing terms like The amount by which government expenditures exceed revenues during a particular 37 year is the A GDP gap. This refers to whether the government is increasing AD or decreasing AD eg.

The usual goals of both fiscal and monetary policy are to achieve or maintain full employment to achieve or. 2The British Virgin Islands has published guidance to suspend local filing pending legislative changes to remove the requirement 3.

Automatic Stabilizers In Fiscal Policy Youtube

Automatic Stabilizers In Fiscal Policy Youtube

The Use Of Fiscal Policy To Stabilize The Economy

Difference Between Automatic Stabilizers And Discretionary Policy Difference Between

0 Response to "Automatic Fiscal Policy"

Post a Comment